Dao Foods views China as the world's most important protein and food market from both a climate impact and business opportunity perspective. Our new series China Food for Thought delves into the rapidly evolving alternative protein sector in China, and the broader market trends within the food industry. We selectively curate and share industry news from China with international audiences that may lack easy access to news and trends in China. Our goal is to provide readers with a ground-up view of valuable industry content from the Dao Foods perspective.

1. Unilever's The Vegetarian Butcher Launches Ready-to-Eat Meals in China

Last month, Unilever’s The Vegetarian Butcher, in collaboration with EGO convenience stores, rolled out three new plant-based ready-to-eat meals across more than 200 locations in Shanghai, Suzhou, and Hangzhou. The new offerings include plant-based fish fillet sandwiches, plant-based tuna salad, and Sichuan-style noodles with plant-based mince. Since its first entry into the Chinese market in late 2020, The Vegetarian Butcher has seen continuous growth over the past three years, says Zihua Zhang, head of The Vegetarian Butcher China.

According to market research in China, The Vegetarian Butcher is strategically focusing on plant-based seafood as a key growth area for the brand. The company identifies a market gap in plant-based seafood, noting the abundance of plant-based beef and chicken alternatives. Additionally, seafood products generally have a high perceived value, and customers are willing to pay more for them. Importantly, The Vegetarian Butcher views plant-based proteins not necessarily as a replacement for animal protein but as complements that enhance the overall diet. As an example of these insights, The Vegetarian Butcher’s new ready-to-eat meal features a plant-based fish fillet. Made from konjac, this fish fillet is rich in dietary fiber and low in calories, positioning it as a nutritious and appealing option for those seeking healthy plant-based foods.

The Vegetarian Butcher remains optimistic about the future of China's plant-based meat market. A market study conducted by The Vegetarian Butcher at the end of 2022 indicated a growing consumer awareness and interest in plant-based products, with a notably positive reception. According to the survey, 96% of participants view plant-based foods as a promising new category, 83% are familiar with it, and 78% recognize these products as distinct from traditional Chinese mock meat.

Resource List:

https://mp.weixin.qq.com/s/vqeN1oq9q7TN8EqIFaHYdg

https://mp.weixin.qq.com/s/CgFlb69biUyKSzr5EGvpew

https://mp.weixin.qq.com/s/Ypmo2oCx3LyPsaOHIPFa-w

https://mp.weixin.qq.com/s/j9aH-ba2iTpkx4vJbHizdw

Dao Foods Perspective:

Initially, The Vegetarian Butcher entered the Chinese market through the B2B restaurant sector, partnering with Burger King to offer plant-based burgers. However, this approach, reflecting global market trends, did not resonate as expected in China.

The Vegetarian Butcher believes that the high nutritional value of plant-based products motivates consumption in the Chinese market. The country already exhibits lower per capita meat consumption compared to Western markets, and its residents have a longstanding integration of plant-based foods in their daily diets. The demand for plant-based options in China stems not just from a desire to have a balanced diet by replacing some of the meat products on the plate, but from a recognition of the multiple health benefits associated with vegetarian diets, such as lowering blood lipids, enriching dietary fiber, aiding digestion, and diversifying meals.

This strategy aligns with the Boston Consulting Group's publication last month, "What the Alternative Protein Industry Can Learn from EV Companies": The most successful alternative protein producers will be those that first meet consumers' needs—which include bridging the taste and price gap—and then out-innovate existing food companies. Companies should leverage technology to innovate in ways that animal protein products cannot. This could mean developing products with additional benefits, such as enhanced nutrition or wellness-promoting functional ingredients.

2. Simon Hill's Plant-based Nutritional Supplement Brand Partners with Harper's Bazaar for Anniversary Celebration

In April, Eimele China marked its fifth anniversary with a grand celebration in Sanya, Hainan, themed "Enjoying Plant-Based Life." The event, co-hosted by the fashion magazine Harper's Bazaar, attracted notable Chinese models Bing Hu and Ying Qu, along with a cadre of fashion influencers. Eimele is a nutritional supplement brand founded by plant-based advocate and influencer Simon Hill.

Simon Hill, known for his substantial social media following of nearly one million on Instagram and his popular podcast, The Proof which boasts over 40 million listens, has also penned the New York Times bestseller "The Proof is in the Plants." His work promotes a plant-based diet underpinned by contemporary nutritional research, resonating with a global audience.

Eimele's flagship product, Essential Rainbow, stands out in the Chinese market. It offers a comprehensive array of plant nutrients sourced from organic fruits and vegetables, including polyphenols, fiber, vitamins, minerals, prebiotics, omega fatty acids, and digestive enzymes, designed to supplement the typically inadequate intake of these foods in everyday diets.

Eimele has partnered with a Chinese e-commerce platform to finely tune its brand positioning and marketing tactics within China. This partnership leverages the popularity of Chinese celebrities, influencers, and Olympic gold medalists to endorse its products. Additionally, Eimele promotes live-stream shopping on platforms like Douyin and RED, where Bing Hu, Ying Qu, and other celebrities have featured Eimele products in their live streams.

Resource List:

https://www.sohu.com/a/774190710_121816089

https://mp.weixin.qq.com/s/RLtEhQG9dky3m3iwD2jDhw

https://mp.weixin.qq.com/s/Lk5vf1chKLimtSad6QQxmw

https://mp.weixin.qq.com/s/AugcAezfTRQIpJH2XHMB2w

Dao Foods Perspective:

By collaborating with e-commerce platforms and leveraging social media, Eimele communicates its brand philosophy and the benefits of its products directly to consumers. The brand also benefits from live-stream shopping and celebrity endorsements. While the plant-based aspect alone may not captivate mainstream consumers, highlighting additional benefits like enhanced metabolism and weight management makes the concept more appealing. This multifaceted approach could serve as a model for other brands aiming to reach a broader audience.

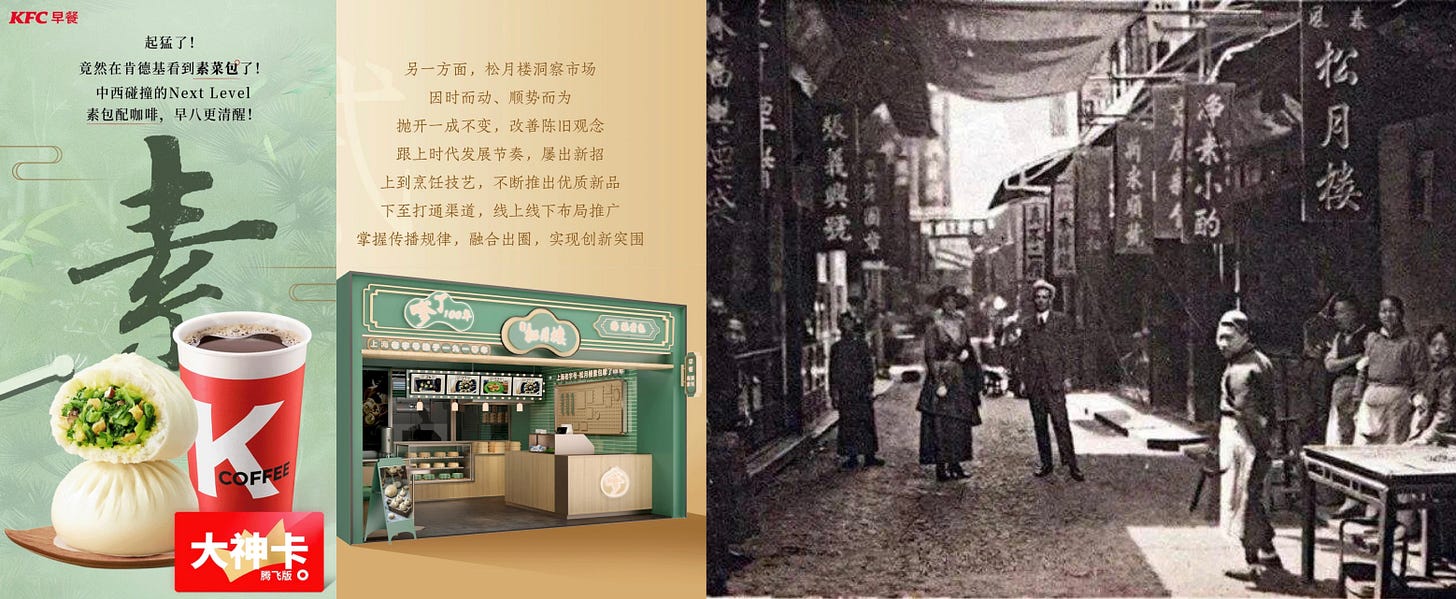

3. KFC China Introduces Vegan Steamed Buns in Partnership with Historic Shanghai Vegan Restaurant

On July 1, KFC China broadened its breakfast offerings with vegan steamed buns. These buns, filled with bok choy, smoked tofu, shiitake mushrooms, and gluten, are now featured in two breakfast combos: two buns with a cup of soy milk priced at US$1.5, or two buns accompanied by a medium Americano for US$1.8.

The vegan steamed buns were developed in collaboration with Spring Breeze Songyuelou, a revered vegan restaurant in Shanghai founded in 1910. Meat buns are often considered too greasy for the morning meal, so these vegan options cater to the Chinese preference for lighter breakfast choices. Initially launched in 2022 for Shanghai outlets, this partnership leverages KFC’s extensive reach alongside Spring Breeze Songyuelou's rich culinary tradition, now available nationwide. Renowned for its long-standing appeal to Shanghainese since the early 20th century, Spring Breeze Songyuelou has recently undergone a rebranding to captivate the mainstream younger customers. This includes a collaboration with the popular Chinese otome game "Mr Love: Queen's Choice," which has extended its market presence.

Resource List:

https://mp.weixin.qq.com/s/cMGBmYDaNRv_KrxxuwKZrA

https://mp.weixin.qq.com/s/q0Ei2qihZoNnXgPLdAzMzQ

https://mp.weixin.qq.com/s/uJRMziT_BPjMMMhRgH0axw

Dao Foods Perspective:

Since introducing its first plant-based sandwich in 2019, KFC China has pursued several plant-based collaborations, including partnerships with Beyond Meat for burgers and crunchwraps, Oatly for oat milk lattes and oat-based ice cream, and Starfield, a Dao Foods portfolio company, for offerings like rice balls and sandwiches. Notably, the vegan bun combos are not strictly vegan as one combo includes tea eggs, and there was a previous combo featuring Century Egg & Pork Congee. For mainstream consumers in China, who naturally consume many plant-based proteins in their diet, offering a vegan dish without emphasizing a fully vegan meal might be a more approachable way to introduce plant-based products in China.

4. China’s National Nutrition Week Promotes Soy Product Consumption

The 2024 National Nutrition Week, organized by the Chinese Nutrition Society, focuses on encouraging residents to increase their consumption of soy and dairy products while reducing the use of cooking oils. This initiative aligns with findings from a 2023 National Health Commission analysis that underscored imbalances in the nation's diet, particularly noting excessive consumption of meat and oil versus inadequate intakes of legumes, vegetables, fruits, and dairy.

Held annually, National Nutrition Week aims to boost public nutrition awareness and foster healthier living habits. Activities spearheaded by local governments, healthcare institutions, and schools include informative sessions and public engagements. For instance, an event in Xiong'an, Hebei, featured the nutrition of plant-based milk and was co-hosted by the Chinese Nutrition Society, the Chinese Center for Disease Control and Prevention, and Yinlu, a leading producer of plant-based milk. This session unveiled the "China Plant-Based Milk Nutrition White Paper." Bing Zhang, Vice Chairman of the Public Nutrition Branch, underscored the critical nutritional role of soy, drawing attention to the prevalent deficiencies in per capita consumption across China.

Throughout the week, practical culinary tips were shared to facilitate the integration of more soy and other legumes into daily diets. Recommendations included incorporating legumes into staple foods, such as adding mixed beans to rice or substituting legume flours in pastries and pancakes. Other suggestions encouraged using legumes as meat substitutes in various dishes and including them in soups, beverages, snacks, and desserts, offering diverse and practical ways to enhance plant-based protein consumption.

Resource List:

https://www.cnsoc.org/pastreviewto/10.html

https://www.cnsoc.org/ctransmissions/0524102014.html?num=10

https://www.cnsoc.org/nMedias/952410200.html?num=10

https://m.caijing.com.cn/api/show?contentid=5012218

Dao Foods Perspective:

China has already established a strong foundation in plant-based protein intake, which is now bolstered by government efforts to promote soy products as part of a healthier dietary regimen. According to the United Nations Food and Agriculture Organization (FAO), in 2021, China surpassed the US in daily per capita protein supply, registering 124.61 grams (4.39 oz), with 60.5% derived from plant-based sources like vegetables, fruits, beans, nuts, seeds, and grains. This marked a significant increase from 2010, with a rise of 15.81 grams (0.55 oz) in plant-based protein, contrasting sharply with the US, where the increase was predominantly from animal products. Additionally, per capita annual consumption of dairy products in China was 34 kg in 2021, significantly lower than in Japan (62 kg) and the USA (231 kg), as noted by Our World in Data.

This trend underscores the significant market potential for plant-based products in China. During National Nutrition Week, the "Enhancing Soy Consumption in China: Guidelines and Benefits" specifically encourages businesses to innovate their soy product offerings, reflecting government backing for this initiative. Tao Zhang, co-founder of Dao Foods, discussed China’s market potential in this area in his TED talk last year.

5. U.S. Commerce Department Finalizes Rulings on Anti-Dumping and Countervailing Duties for Chinese Pea Protein

On August 2, 2023, the U.S. Department of Commerce launched anti-dumping investigations into Chinese pea protein imports, citing significant concerns over unfair pricing practices. The preliminary findings, released on February 8, 2024, revealed dumping margins ranging from 122.19% to 280.31%. The Commerce Department solidified its stance with a final determination on June 28, 2024. In a related move, Canada initiated its own anti-dumping and countervailing duty investigations on April 22, 2024, reflecting growing international scrutiny over Chinese pea protein practices.

China stands as the world’s largest processor of peas, importing approximately two million tons annually, primarily from Western countries. Canadian peas dominate this import market, comprising up to 93% of China’s total pea intake.

Derek Drayson from Agrocorp International highlighted the gravity of the situation, noting that all Canadian pea exports to China are directed towards the fractionation market. He warned that the imposition of punitive duties by the U.S. could drastically reduce the flow of Canadian peas to China, potentially reshaping global supply chains.

China broadened its pea import sources at the end of 2022 by granting access to Russian peas, with the first shipments arriving in spring 2023. Ukraine is also expanding its footprint in the Chinese market, with projected exports of 258,000 tonnes for 2023-24, bolstered by a recent phytosanitary agreement with China.

Shuangta Food, a major player in the pea protein sector, reported that 80% to 90% of its output was exported to markets including the U.S., Europe, and Japan in 2022. Pea protein exports to the U.S. alone accounted for 8.14% of its total revenue that year. Meanwhile, the construction of Shuangta’s new factory in Thailand is advancing as planned, positioning the company to meet evolving global demands despite the challenging regulatory environment.

Resource List:

https://mp.weixin.qq.com/s/wJKrTWr8wbFa-wNtZ0-Q-w

https://www.producer.com/news/anti-dumping-case-may-affect-pea-flow/

https://www.trade.gov/final-determinations-antidumping-and-countervailing-duty-investigations-certain-pea-protein-china#:~:text=On June 28%2C 2024%2C the,Republic of China (China).&text=Fenchem Biotek Ltd.,Shuangta Food Co.%2C Ltd.

https://www.cbsa-asfc.gc.ca/sima-lmsi/i-e/hpc2024/hpc2024-np-eng.html

https://finance.eastmoney.com/a/202407303143677670.html

Dao Foods Perspective:

Global food supply chains have always been complicated and are increasingly subject to complex geopolitics. Dao Foods’ impact mandate is to reduce the demand for animal protein by catalyzing the increased availability of exciting alternative protein products for Chinese and global consumers, so we hope that geopolitics does not get in the way of increased volume and decreased cost of plant protein inputs necessary in many of these new alternative protein products. Tao Zhang, co-founder of Dao Foods, in particular calls for more attention and engagement from international stakeholders and investors to China’s alternative protein sector from an impact perspective, again in his TED talk last year.